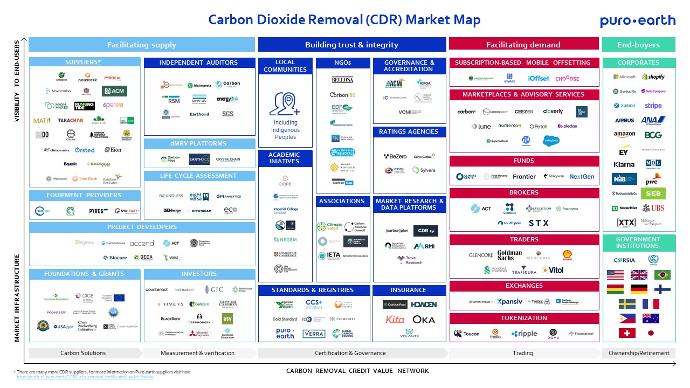

The voluntary carbon market is evolving and expanding to meet the challenges of a world striving to meet the demands of net zero while aiming for greater climate and sustainability justice. In our 2023 Market Map of the "New" Voluntary Carbon Market, we provided a comprehensive overview of a market that had quadrupled in magnitude over two years, reaching an approximate value of $1.3 billion. According to McKinsey research, that value could grow could grow to more than $50 billion by 2030.

As we present our updated 2024 version, it looks at the evolution of the market, focusing on durable carbon removal in 2024 and an overview of the carbon removal value chain.

We do acknowledge that this map simply serves as a representative overview of the CDR landscape. It was not possible to include all the players and innovators shaping the market including all of our valued Puro.earth suppliers and their 159 projects, as well as our partners. We focused on the larger volumes of issued and forecasted carbon removal credits, using data from the Puro Registry and external sources, including CDR.fyi, while spanning and representing all the regions across the globe, as well as the variety of CDR methodologies.

Download the CDR market map

Why focus on durable carbon removal?

Durable carbon removal is defined as processes that remove carbon dioxide from the atmosphere with a minimum storage duration of 100+ years. This shift aims to strengthen the market's impact in addressing climate change by ensuring solutions convincingly compensate for fossil emissions.

Value Chain Categories & Changes in Market Dynamics

Our 2024 Market Map introduces a restructured layout and subdivides the Carbon Dioxide Removal (CDR) ecosystem into a loose form of a value network. Spanning from the supply side, where climate action occurs, the certification and governance bodies that help to strengthen the integrity of the market, to the demand side, transforming this action into sellable products, and finally, the end users, resulting in the consumption (/retirement) of carbon removal credits. Let’s take a look at these categories in greater detail along with observations on how the market has evolved in the past year.

1. Facilitating Supply

On the left side of the map, are the entities actively engaged in climate action itself.

First up are the Carbon Removal Suppliers, the pioneers who make the magic happen. They own the processes and products that remove carbon from the atmosphere. For the full list of Puro.earth suppliers, please visit our supplier listing.

Carbon Removal Suppliers and their processes are supported by the following pillars:

- Equipment Providers: Ensuring technical efficiency and efficacy of carbon removal processes.

- Project Developers: Specializing in bringing carbon removal projects to fruition.

- Independent Auditors, dMRV Platforms, and Life Cycle Assessment Providers: The custodians of transparency, rigorously assessing and ensuring the accuracy of carbon removal efforts.

- Foundations & Grants, and Investors: Providing essential financial support for early-stage development and expansion projects.

The supply side has witnessed a surge in innovation and financial backing, with a notable increase in early-stage development projects. The focus on transparency and accuracy has intensified, reflecting the market's commitment to robust carbon removal efforts.

2. Building Trust and Integrity

Moving along, we come to the certifiers and governance entities reinforcing the ethical and robust conduct of CDR initiatives:

- Local Communities: Integral stakeholders that foster inclusivity in the CDR market, ensuring the consideration of diverse perspectives and the needs of those directly impacted by its practices.

- NGOs (Non-Governmental Organizations): Acting as external watchdogs, advocating for community and environmental interests as well as building a credible CDR market in the wider sustainable transformation.

- Academic Initiatives: Validating and enhancing the scientific foundations through research and development in the field of CDR.

- Standards and Registries: Providing the frameworks and guidelines for certification of the measurement, verification, and reporting of carbon removal activities.

- Governance and Accreditation: Overseeing and accrediting Standards and Registries to ensure responsible practices.

- Ratings Agencies: Evaluating impact and integrity, providing clarity and confidence for stakeholders navigating the market.

- Market Research and Data Platforms: Offering insights into market dynamics and emerging opportunities.

- Insurance: Mitigating risks and ensuring the resilience of CDR projects and purchases against unforeseen challenges.

Trust and integrity have become major themes of the evolving market, with an increased focus on inclusivity, environmental safeguards, and external governance and validation. Regulatory frameworks have seen enhancements to guide ethical practices, reflecting a maturing market.

3. Facilitating Demand Side

Continuing across the map, we shift focus to the buy-side facilitators connecting carbon removal initiatives with entities seeking to neutralize their emissions and/or invest in building the market:

- Subscription-based Mobile Offsetting: Simplifying ongoing carbon removal contributions for individuals and businesses.

- Marketplaces and Advisory Services: Serving as intermediaries, connecting buyers with a diverse range of carbon removal projects. These platforms provide insights, guidance, and access to a variety of projects, enabling informed decision-making for those looking to invest.

- Funds: Investment funds dedicated to carbon removal projects, inspired by the collaborative spirit of buyer-driven groups, play a crucial role in channelling financial support.

- Traders: Facilitating the exchange of carbon credits for liquidity and market efficiency.

- Exchanges: Serving as hubs for carbon credit trading, enhancing market transparency.

- Tokenization: Introducing a new dimension by making carbon credits available for trading as tokenized assets.

The demand side has witnessed an influx of diverse players, with increased accessibility through subscription-based models and innovative trading mechanisms. The role of demand side advisories is expected to grow as new end-buyers with less experience in the marker come into the scene. Financial support channels have diversified, contributing to the overall liquidity and efficiency of the market.

4. End-Buyers

At the end of the value network, corporations and governments emerge as end-buyers, making a lasting impact through the consumption and retirement of carbon removal credits:

- Corporations: Demanding transparency and quality in procured carbon credits, with some implementing in-house carbon credit marketplaces.

- Governments: Playing a pivotal role in shaping policies and contributing to national and global efforts to combat climate change.

End-buyers have become more discerning, emphasizing transparency and quality in their carbon credit acquisitions. The trend signifies a shift in how corporations actively engage with impactful projects. We expect an influx of new corporate buyers into the realm in their efforts to meet sustainable and net zero goals, but will it be enough to grow an industry needed to achieve to remove around 6 GtCO2 per year by 2050?

Download the high-resolution market map and start exploring the CDR market of 2024.