Recently, the Science Based Targets Initiative (SBTi) released its Beyond Value Chain Mitigation (BVCM) guidance, and the University of Oxford issued a revision to its Net-Zero Aligned Carbon Offsetting principles. Both are supportive of durable carbon removal and make it clear that in order to scale it, investment is needed now. Below, we unpack the key points and explain how the initiatives fit together and explain why integrating durable carbon removal is key to demonstrate net-zero aligned climate action.

What is Beyond Value Chain Mitigation and what did the SBTi publish?

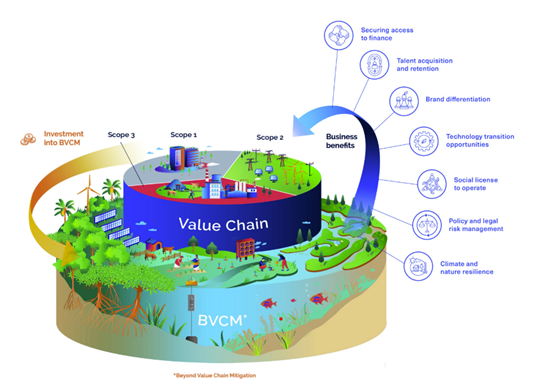

As stated by SBTi, “BVCM is defined as mitigation action or investments that fall outside a company’s value chain, including activities that avoid or reduce GHG emissions, or remove and store GHGs from the atmosphere, see diagram below”. It is included as a best practice recommendation rather than criteria which must be met in order for a company’s net-zero target to be validated by the SBTi. As stated by Patch, “the BVCM is now an official step in SBTi’s target-setting process with an official framework. It is not required”. Therefore, the role of high-quality carbon credits is recognized as a potential pathway for high ambition climate action.

Notable references to durable carbon removals and carbon credits include:

- Investment in CDR innovation and R&D is needed now since the amount of CDR needed in the second half of the century will only be feasible if we see substantial capital deployment in the next ten years.

- BVCM also represents an opportunity to accelerate the development of CDR technologies needed to neutralize the impact of residual emissions by mid-century and thus to mitigate future costs and secure access to permanent removals.

- A company in a heavy emitting sector might consider funding the scale-up of CDR technology as a long-term risk management strategy to secure access to removals needed for neutralizing its residual emissions at the net-zero target date and thereafter.

- Where carbon credits are the mechanism for deploying BVCM, credits should be verified by an independent third party to the protocols of a high-quality carbon standard.

What did the University of Oxford publish?

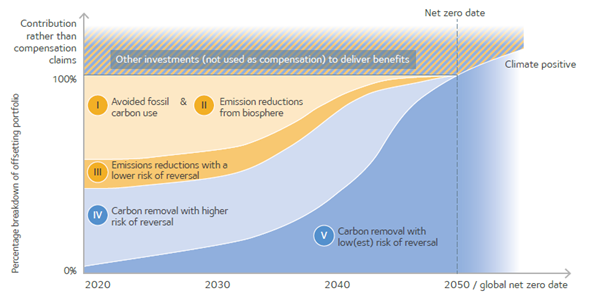

The University of Oxford published a revision of its net-zero aligned carbon offsetting principles (see Figure below). The Principles are intended to guide buyers of carbon credits, and can also be used to guide carbon project developers and intermediaries, who have an enormously important role to play and can adopt the spirit of the Principles by actively advocating that their customers shift their demand. The principles include guidance on durable carbon removals:

- The only way to achieve and maintain net zero is to either not emit in the first place, or to compensate any residual emissions with durable removals

- Shift to removals with durable storage (low risk of reversal) to compensate residual emissions by the net zero target date

- Organizations must shift towards carbon removals, which remove carbon from the atmosphere to counterbalance residual emissions and achieve net zero. Those targeting net zero with the use of credits will need to increase the proportion that comes from carbon removal, rather than from emission reductions, aiming to reach 100% carbon removal credits by the global net zero date (2050 at the latest).

- However, the current deployment level of durable carbon removal and storage approaches is well below what is needed. It is critical that investment in these methods begins early and ramps up rapidly to ensure they are available at the scale needed to meet the demand required to achieve global net zero.

Example of a Net Zero Aligned Offsetting Portfolio:

How do the SBTi’s BVCM guidance and the Oxford Offsetting Principles for Net-Zero fit together with other voluntary rule-setters?

Both SBTi and Oxford seek to enable the world to reach net-zero and see a key role for high-quality carbon credits from voluntary carbon markets, including durable carbon removal.

Oxford focuses on value chain emissions (also referred to as Scope 1 – direct emissions, Scope 2 indirect emissions, and Scope 3 – from the use of products) and this SBTi guidance focused on emissions outside the value chain, called BVCM. In the figure above, the striped area refers to the BVCM.

Furthermore, the SBTi references how claims made under the Voluntary Carbon Market Initiative (VCMI) can be used to align with their BVCM guidance, “At the time of publication, the SBTi does not have plans to validate BVCM claims, particularly given that others are already working to define BVCM-related claims, including the Voluntary Carbon Market Integrity Initiative (VCMI).”

The VCMI references the importance of transitioning to IC-VCM labelled carbon credits, stating “The VCMI Claims Code of Practice requires that carbon credits used towards the VCMI Claims are of the highest quality, they must meet the Integrity Council for the Voluntary Carbon Market (ICVCM) Core Carbon Principles (CCPs) and qualify under its Assessment Framework. VCMI has developed a set of transitional measures for companies to adhere to in the interim as supply of CCP-Approved credits scale-up in the market.”

So we start to see the end-2-end integrity that was announced at COP28, where multiple enabling frameworks are collaborating to guide corporations on their net zero journeys

Next steps for durable carbon removal

- Puro welcomes clear guidance from the SBTi and University of Oxford that companies can follow and implement.

- We look forward to continue our work with companies who are supplying and buying CO2 Removal Certificates from durable carbon removal projects to deliver the net in net-zero emissions.

- We welcome that the BVCM is part of the SBTi’s net-zero standard and ask that the main net-zero standard is updated to include neutralization milestones on the pathway to net-zero emissions.

- We continue our work to ensure that the Puro Standard evolves through our updated General Rules so companies can neutralize remaining emissions with high-integrity carbon removal credits. We have submitted our application to the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA), and in the near future will be sending our application to the Integrity Council for the Voluntary Carbon Market (IC-VCM).

Are you ready to add carbon removal to your climate actions? Get in contact today!